WI Form 3-2003 free printable template

Show details

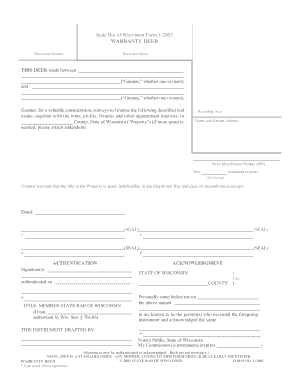

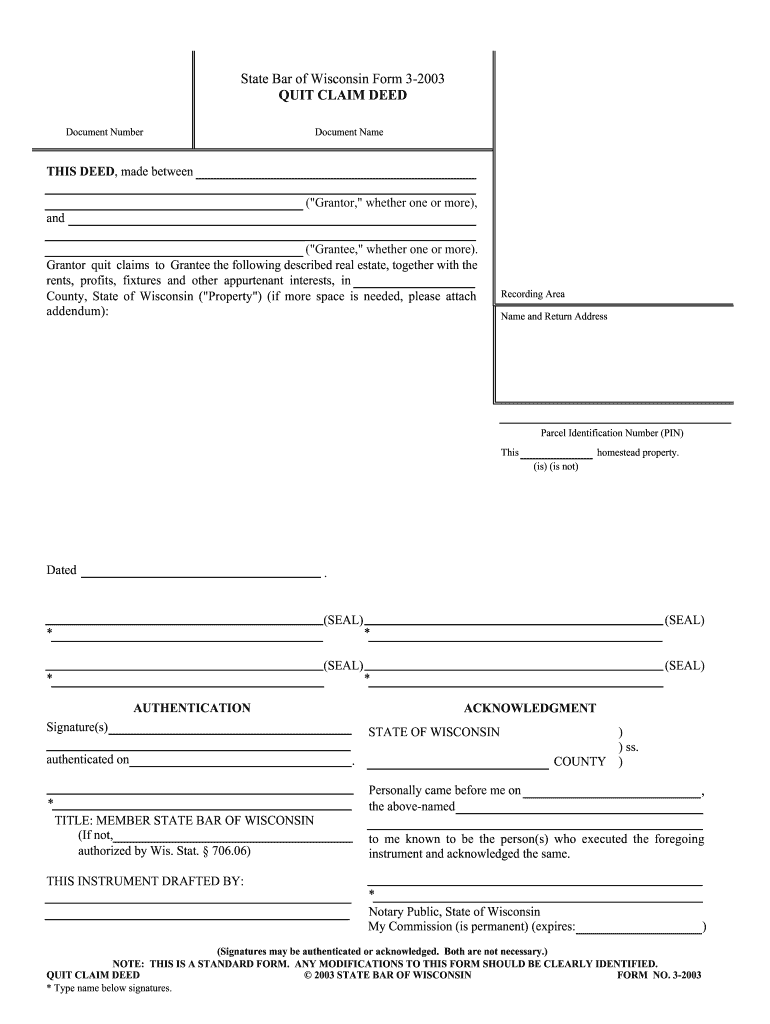

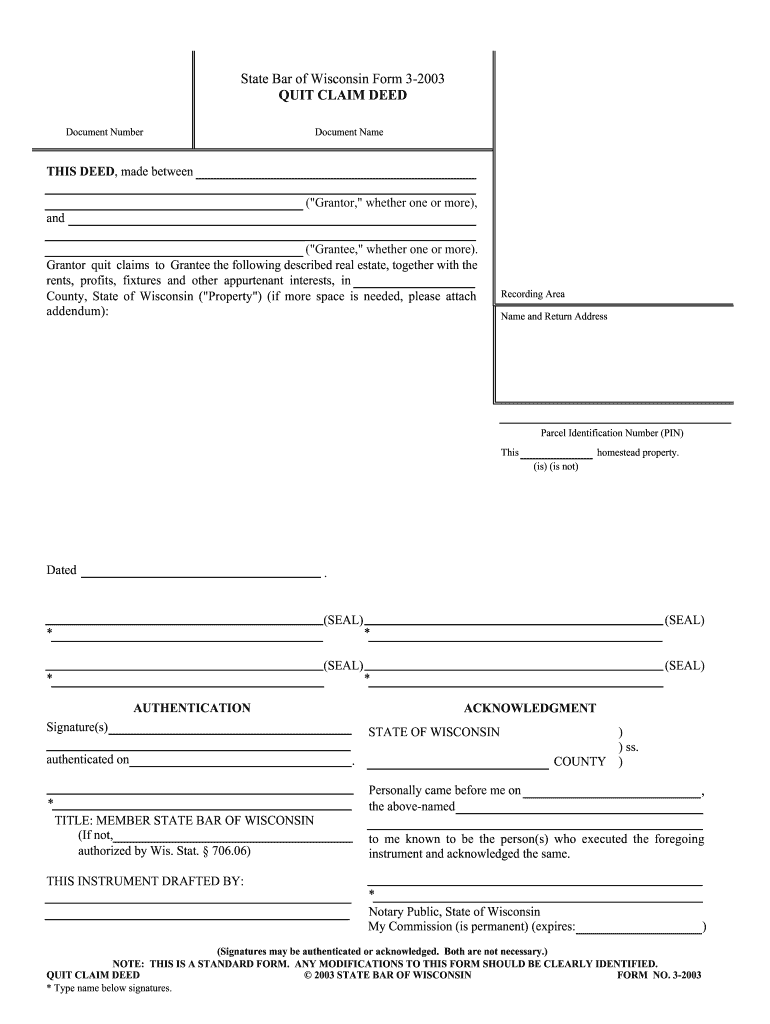

State Bar of Wisconsin Form 3-2003 QUIT CLAIM DEED Document Number THIS DEED made between Grantor whether one or more and Grantor quit claims to Grantee the following described real estate together with the rents profits fixtures and other appurtenant interests in County State of Wisconsin Property if more space is needed please attach addendum Recording Area Name and Return Address Parcel Identification Number PIN This homestead property. NOTE THIS IS A STANDARD FORM. ANY MODIFICATIONS TO...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign wisconsin form 3 2003

Edit your wisconsin quit claim deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state bar of wisconsin form 3 2003 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 3 2003 online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wisconsin quitclaim deed printable form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out quit claim deed wisconsin form 3 2003

How to fill out WI Form 3

01

Obtain a blank WI Form 3 from the Wisconsin Department of Revenue website or your local office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Indicate the tax year for which you are filing the form.

04

Provide details for all income sources you are reporting.

05

Complete the deductions section by listing any applicable deductions you wish to claim.

06

Calculate your total taxable income and apply any credits.

07

Review the form for accuracy and completeness.

08

Sign and date the form before submission.

Who needs WI Form 3?

01

Individuals who need to report income, claim deductions, or credits for tax purposes in Wisconsin must fill out WI Form 3.

Fill

quit 3 bar

: Try Risk Free

People Also Ask about state bar of wisconsin form 21 2003 mortgage

What are the requirements for a quit claim deed in Wisconsin?

All statutory requirements generally applicable to Wisconsin deeds are equally applicable to quitclaim deeds.Required items include: Names of the parties to the deed; A legal description of the real estate; Material terms or conditions of transfer;33 and, The identity of the individual who prepared the deed.

How do I add someone to my deed in Wisconsin?

Use form 9400-623 if you are primary owner on record and you want to add or remove an owner to the certificate of title or if you want to add a lien (i.e. to request a lien notation). Form 9400-193.

Is grantor the same as owner?

A grantor is the person who owns a given asset. In real estate, the grantor is the current property owner. Typically, this type of language is used when transferring ownership or selling a home. In these situations, the grantor is the one selling or giving the property to another party.

Where do you file a quit claim deed in Wisconsin?

Recording (W.S.A. 706.05) – The quit claim deed must be filed at the County Register of Deeds. Signing (W.S.A. 706.06) – Required to be signed with the Grantor(s) and a Notary Public.

What is the difference between a grantor and a grantee?

What Are Grantors And Grantees? There are two sides to a transaction. In real estate, a grantee is the recipient of the property, and the grantor is a person that transfers ownership rights of a property to another person. However, the specifics of their transaction may vary depending on the situation.

What does grantor mean in a deed?

The Grantor is any person conveying or encumbering, whom any Lis Pendens, Judgments, Writ of Attachment, or Claims of Separate or Community Property shall be placed on record. The Grantor is the seller (on deeds), or borrower (on mortgages). The Grantor is usually the one who signed the document.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the wisconsin deed 3 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your wisconsin quit claim deed pdf.

How do I fill out wisconsin quit claim deed form using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign claim 3 quit and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out quit claim deed wisconsin on an Android device?

Complete state bar of wisconsin form 3 2003 fillable and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is WI Form 3?

WI Form 3 is a document used for reporting specific information related to Wisconsin tax obligations, generally related to certain types of income.

Who is required to file WI Form 3?

Entities or individuals who have specific income sources or tax situations requiring them to report under Wisconsin tax law are required to file WI Form 3.

How to fill out WI Form 3?

To fill out WI Form 3, gather all necessary income and tax information, follow the instructions provided with the form, and ensure all sections are completed accurately before submitting.

What is the purpose of WI Form 3?

The purpose of WI Form 3 is to ensure that taxpayers report their income correctly and comply with Wisconsin state tax regulations.

What information must be reported on WI Form 3?

WI Form 3 requires reporting information such as income earned, deductions, exemptions, and any credits applicable under Wisconsin tax law.

Fill out your WI Form 3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fillable Wisconsin Deed Fillable is not the form you're looking for?Search for another form here.

Keywords relevant to printable form 3 2003

Related to how to complete a wisconsin quit claim deed

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.